social security tax limit 2021

3345 at age 66 and 4 months. In 2021 the maximum benefit increases by 137 per month to 3148.

What S The Maximum Social Security Tax In 2021 The Motley Fool

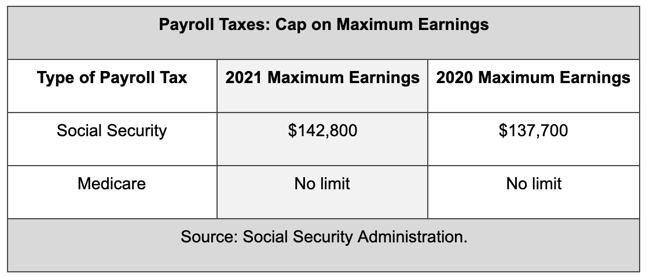

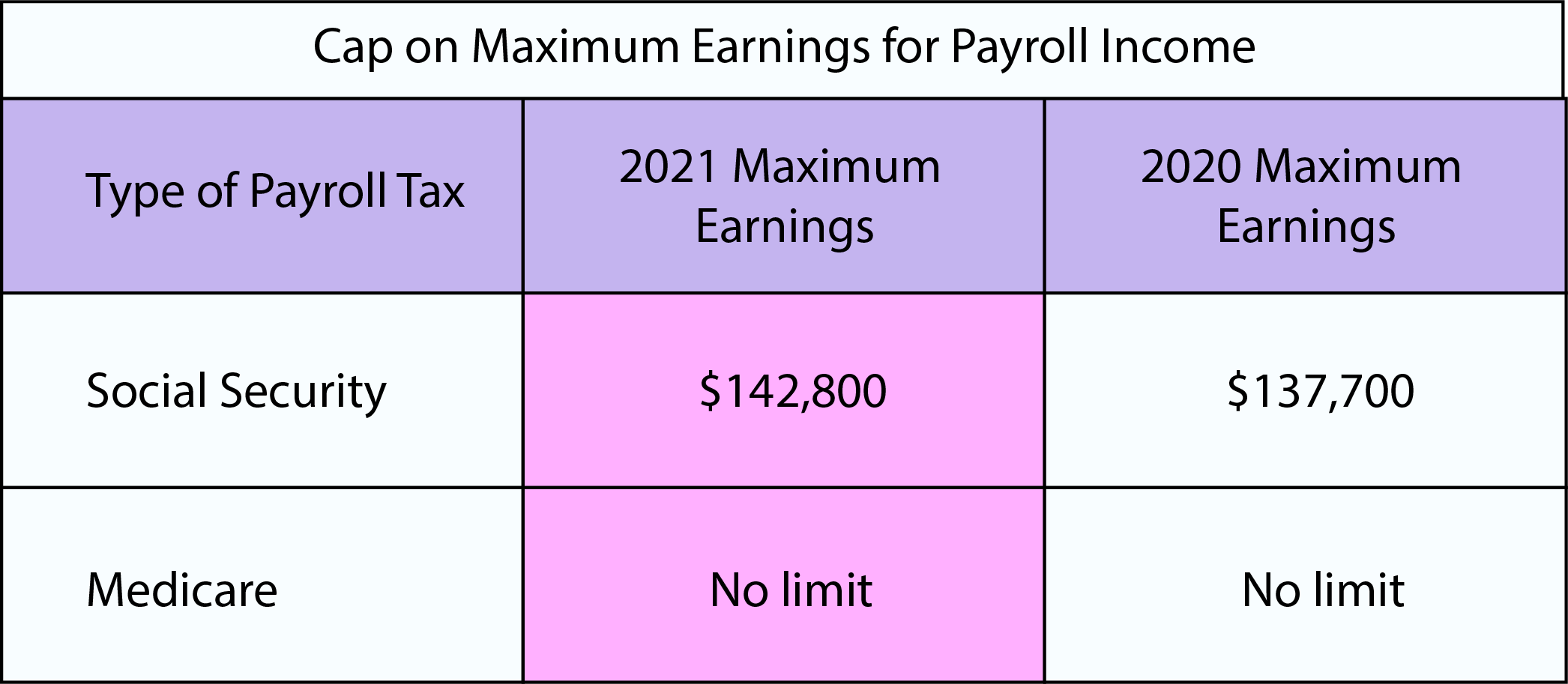

This amount is also commonly referred to as the taxable maximum.

. The maximum possible Social Security benefit in 2022 depends on the age you begin to collect payments and is. Social Security and Medicare taxes. 9 rows This amount is known as the maximum taxable earnings and changes each year.

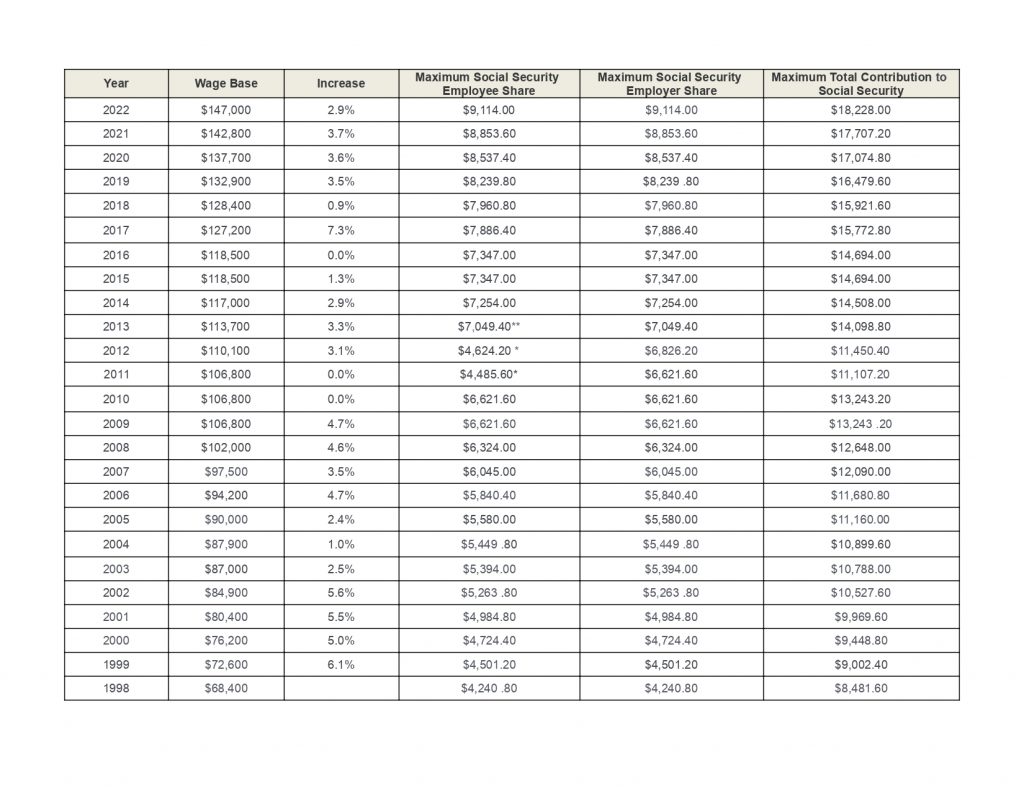

The Social Security taxable maximum is adjusted each year to keep up with changes in average wages. Worksheet to Determine if Benefits May Be Taxable. The tax rate for 2022 earnings sits at 62 each for employees and employers.

B One-half of amount on line A. So individuals earning 147000 or more in 2022 would contribute 9114 to the OASDI program. The Social Security taxable maximum is 142800 in 2021.

Between 25000 and 34000 you may have to pay income tax on. The Social Security tax limit is the maximum amount of earnings subject to Social Security tax. The maximum amount of Social Security tax an employee will have withheld from their paycheck in 2023 will be 9932 147000 x 62 and 9114 147000 x 62 in year.

Wage Base Limits. Workers pay a 62. It is also the maximum amount of covered wages that are taken into account when average earnings are calculated in order to determine a workers Social Security benefit.

You will pay tax on only 85 percent of your Social Security benefits based on Internal Revenue Service IRS rules. By joseph June 15 2022. 4 Whats the maximum taxable income for Social Security in 2019.

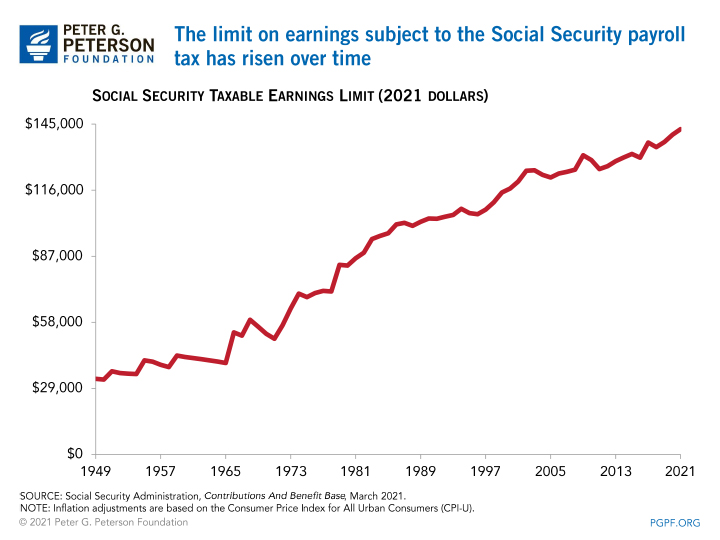

The federal government sets a limit on how much of your income is subject to the Social Security tax. The maximum earnings that are taxed have changed over the years as shown in the chart below. However if youre married and file separately youll likely have to pay taxes on your Social Security income.

The 2021 tax limit is 5100 more than the 2020 taxable maximum. If that total is more than. Employeeemployer each Self-employed Can be offset by income tax provisions.

What is the income limit for paying taxes on Social Security. Fifty percent of a taxpayers benefits may be taxable if they are. We call this annual limit the contribution and benefit base.

Maximum taxable earnings will. This is the largest increase in a decade and could mean a higher tax bill for some high earners. The 2022 limit for joint filers is 32000.

The wage base limit is the maximum wage thats subject to the tax for that year. 2364 at age 62. For earnings in 2022.

As a result the Trustees. Single filers with a combined income of 25000 to 34000 must pay income taxes on up to 50 of their Social Security payments for the 2021. For earnings in 2022 this base is 147000.

If you earned more than the maximum in any year whether in one job or more than one we only. SSI payment rates and resource limits January 2021 in dollars Program aspect Individual Couple. The OASDI tax rate for.

Only the social security tax has a wage base limit. In 2021 the Social Security tax limit is 142800 up from 137700 in 2020. For the 2021 tax year which you will file in 2022 single filers with a combined income of 25000 to 34000 must.

Filing single single head of household or qualifying widow or widower with 25000 to 34000 income. In 2023 the Social Security tax limit is 160200 up from. A Amount of Social Security or Railroad Retirement Benefits.

IRS Tax Tip 2021-66 May 12 2021 Taxpayers receiving Social Security benefits may have to pay federal income tax on a portion of those benefits.

Payroll Taxes What Are They And What Do They Fund

New Mexico May Limit Or Scrap Tax On Social Security Income

Taxes And Social Security In 2020 Everything You Need To Know Simplywise

The Evolution Of Social Security S Taxable Maximum

What Is The Bonus Tax Rate For 2022 Hourly Inc

Increased Wage Inequality Has Reduced Social Security S Revenue Center For American Progress

Social Security Wage Base 2021 And Updated For 2022 Uzio Inc

2021 Wage Base Rises For Social Security Payroll Taxes

What Is The Maximum Social Security Tax In 2021 Is There A Social Security Tax Cap As Usa

Final Regs Modify Clarify 401 K Hardship Distribution Rules

Maximum Social Security Tax In 2021

Social Security Increases For 2021 Flaster Greenberg Pc Jdsupra

Maximum Social Security Tax 2022 What To Know About Social Security If You Re In Your 60s ह दक ज

Research Income Taxes On Social Security Benefits

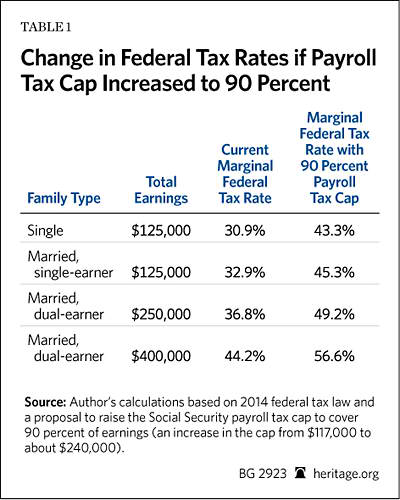

Raising The Social Security Payroll Tax Cap Solving Nothing Harming Much The Heritage Foundation

Social Security Tax Limit Wage Base For 2022 Smartasset

Social Diability Lawyer Social Disability Lawyer Blog Fica Taxes For Social Security Disability In 2021

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons